January 12, 2026

audit readiness checklistISO 27001 complianceISO 13485 auditquality managementcompliance automation

The Ultimate 8-Point Audit Readiness Checklist for 2026

Master your next audit with our comprehensive audit readiness checklist. Discover 8 key steps for ISO 27001, 13485, and 9001 compliance and readiness.

25 min readAI Gap Analysis

Facing an audit can feel like preparing for an exam you can't afford to fail. The pressure is immense, the stakes are high, and the sheer volume of required documentation can be overwhelming. Traditional audit preparation often involves a frantic, last-minute scramble to locate documents, verify controls, and hope for the best. This reactive approach is not only stressful but also risky, leading to surprise findings, delayed certifications, and a continuous cycle of audit anxiety.

What if you could transform this process from a reactive sprint into a strategic, ongoing marathon? True audit readiness isn't about a final destination; it's about maintaining a constant state of compliance. This comprehensive audit readiness checklist provides a strategic, 8-point framework designed to build that culture of continuous compliance within your organization. We move beyond generic advice to provide actionable steps and specific examples tailored for key frameworks like ISO 27001, ISO 13485, and ISO 9001.

This guide details exactly how to manage evidence, conduct gap assessments, verify controls, and prepare for auditor interactions. You'll learn how to systematically prepare, maintain, and prove your compliance posture year-round. Following this checklist will help you turn your next audit into a confident demonstration of your organization’s operational excellence, not a stressful last-minute ordeal. This is your blueprint for turning audit season from a source of anxiety into a validation of your hard work.

1. Document Collection and Evidence Management

The cornerstone of any successful audit is a robust system for document collection and evidence management. This foundational step involves systematically gathering, organizing, and maintaining all documentation required to demonstrate compliance. Think of it as building the library from which an auditor will borrow books; if the library is a mess, finding the right information becomes a frustrating, time-consuming exercise that immediately raises red flags. This process is crucial for a smooth audit readiness checklist because it directly impacts an auditor's ability to efficiently verify your claims.

Effective evidence management transforms abstract compliance statements into tangible, verifiable proof. It ensures that every policy, procedure, log, and record is not only present but also easily accessible, current, and clearly linked to specific audit requirements. Without this, even a fully compliant organization will struggle to pass an audit.

Why This Is a Critical First Step

A disorganized approach to documentation is one of the fastest ways to fail an audit. Auditors need to see a clear, logical trail of evidence. When documents are missing, outdated, or difficult to find, it suggests that the underlying compliance processes may be equally chaotic. A well-structured evidence repository, on the other hand, projects competence and control from the very start.

Practical Implementation Examples

- ISO 27001 (Information Security): A technology company maintains a centralized, version-controlled repository for its Information Security Management System (ISMS). This includes access control policies (linked to specific user roles), quarterly user access review reports, and logs from their Security Information and Event Management (SIEM) system demonstrating continuous monitoring.

- ISO 13485 (Medical Devices): A medical device manufacturer uses a Quality Management System (QMS) software to manage its Design History File (DHF). Every document, from initial user requirements to final validation test reports, is digitally signed, time-stamped, and linked, creating an unimpeachable traceability matrix for auditors.

- ISO 9001 (Quality Management): An engineering firm archives minutes from its quarterly management review meetings in a shared drive with a strict naming convention (e.g., YYYY-MM-DD_MgmtReview_Minutes). Customer feedback forms and corrective action reports are similarly organized, allowing for quick retrieval during an audit.

Actionable Tips for Success

- Create a Master Document Index: Develop a spreadsheet or use a GRC platform to map every required document to its corresponding control or clause in the standard. This index becomes your audit roadmap.

- Standardize Naming Conventions: Implement a consistent naming convention that includes the document type, date, and relevant control ID (e.g., ISMS-POL-001_Access_Control_Policy_v2.1). This makes searching for evidence dramatically faster.

- Automate Evidence Discovery: Leverage tools that use AI to automatically parse existing documentation and categorize it against framework requirements. This can significantly reduce manual effort in the initial stages of a gap assessment process and help identify gaps in your evidence collection.

- Schedule Regular Reviews: Don't wait for an audit to clean up your records. Schedule quarterly reviews to archive outdated documents, verify that current versions are in use, and ensure all new processes are properly documented.

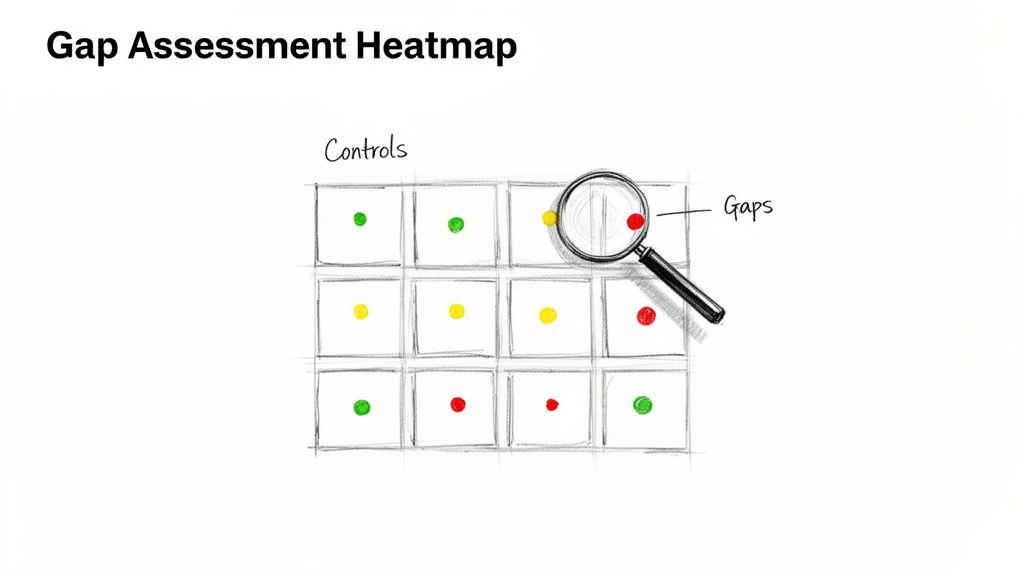

2. Gap Assessment Against Compliance Frameworks

Before an auditor formally evaluates your systems, you must first audit yourself. A gap assessment is a systematic evaluation that compares your organization's current practices, policies, and controls against the specific requirements of a target compliance framework. It is the diagnostic phase of audit preparation, designed to uncover exactly where you are compliant, where you fall short, and the magnitude of the remediation effort required. This step is a non-negotiable part of any audit readiness checklist, as it provides the strategic roadmap for all subsequent compliance activities.

This process moves beyond a simple "yes/no" checklist. A thorough gap assessment quantifies the deficiencies, identifying controls that are missing entirely, implemented but not documented, or documented but not functioning as intended. Without this clarity, remediation efforts become a guessing game, wasting valuable time and resources on low-priority issues while critical vulnerabilities remain unaddressed.

Why This Is a Critical Next Step

Attempting an audit without a prior gap assessment is like taking a final exam without ever reviewing the course material. It exposes the organization to a high risk of non-conformities, which can lead to a failed audit, costly re-audits, and reputational damage. A gap assessment identifies these weaknesses preemptively, allowing you to prioritize and fix them on your own timeline, turning a potentially stressful audit into a validation of work already completed.

Practical Implementation Examples

- ISO 27001 (Information Security): A SaaS company performs a gap assessment and discovers it lacks formal logging and monitoring procedures required by Annex A control A.12.4.1. This finding prompts them to implement a SIEM tool and develop corresponding operational procedures before the external audit.

- ISO 13485 (Medical Devices): During their assessment, a medical device manufacturer identifies that their design verification documentation is incomplete for a new product, a clear gap against clause 7.3.6. They immediately initiate a project to complete the required testing and update the Design History File.

- ISO 9001 (Quality Management): A manufacturing firm realizes that while management reviews happen informally, they lack documented evidence (agendas, minutes, action items) required by clause 9.3. The gap assessment highlights this, and they implement a formal, documented quarterly review process.

Actionable Tips for Success

- Create a Remediation Heatmap: Visualize assessment results with a color-coded heatmap (red, yellow, green) organized by control domain. This provides an at-a-glance status report for executive discussions and helps prioritize resources.

- Prioritize High-Impact Controls: Focus initial remediation efforts on gaps that pose the greatest risk, such as those related to customer data security, patient safety, or critical product quality, as these will receive the most auditor scrutiny.

- Use AI for Comprehensive Analysis: Instead of manually sampling documents, leverage AI-powered tools to analyze all evidence simultaneously. This approach provides a more accurate and complete picture of your compliance posture, as you can explore a comprehensive ISO 27001 gap assessment in a fraction of the time.

- Perform Assessments Iteratively: Conduct gap assessments quarterly, not just once. This transforms the process from a one-time event into a continuous improvement cycle, allowing you to track remediation progress and adapt to any changes in your environment or the standard itself.

3. Policy and Procedure Documentation Review

Policies and procedures are the formal "rulebook" of your organization, defining how it meets its compliance obligations. This step involves a meticulous review and update of all this documentation to ensure it is not only aligned with the chosen compliance framework but also accurately reflects current operational practices. Auditors scrutinize these documents to understand intent; they then look for evidence that these intentions are being carried out. This is a critical part of any audit readiness checklist because outdated or misaligned policies are a direct route to a non-conformity.

Effective policy management demonstrates a commitment to governance and continuous improvement. It proves that your compliance program isn't just a static project but a living, breathing part of your organizational culture. If your procedures describe a process that no one actually follows, auditors will view it as a significant control failure.

Why This Is a Critical Review Step

Policies are the "say what you do" part of compliance, while procedures and records are the "do what you say." If the initial statement of intent (the policy) is flawed, outdated, or disconnected from reality, the entire compliance structure built upon it is fundamentally weak. Auditors will check for clear approval chains, review dates, and version history to confirm these documents are actively managed, not just written once and forgotten.

Practical Implementation Examples

- ISO 27001 (Information Security): A SaaS company reviews its overarching Information Security Policy and its supporting documents, such as the Access Control Policy and Incident Response Plan. They update the policies to reference new cloud infrastructure and ensure the procedures reflect the use of their current identity and access management (IAM) tool.

- ISO 13485 (Medical Devices): A diagnostics firm updates its Quality Manual and associated procedures for design control and complaint handling. The review ensures the documentation explicitly addresses the latest regulatory requirements for post-market surveillance and risk management throughout the product lifecycle.

- ISO 9001 (Quality Management): A manufacturing business revises its Quality Management System (QMS) documentation. They update their change control procedure to include a formal risk assessment step for any proposed process modifications, ensuring changes are evaluated for their impact on product quality.

Actionable Tips for Success

- Create a Policy Inventory: Develop a master spreadsheet that maps every policy and procedure to its owners, last review date, next review date, and the specific framework clauses it addresses.

- Audit Policies Against Requirements: Before writing new documents, perform a gap analysis of your existing policies against the standard's requirements to identify what is missing or needs updating.

- Validate Against Reality: Don't just read the documents. Interview team members responsible for implementing the procedures to confirm that the documented steps match their real-world actions.

- Embed Responsibility and Timelines: Each policy should clearly state who is responsible for its implementation and include version control with approval dates. Schedule annual policy reviews as a recurring task tied to your management review process.

4. Control Implementation and Testing Verification

Having well-documented policies is only half the battle; the real test is proving that your controls are implemented, functioning as intended, and consistently effective. This stage moves beyond theory into practical validation. It involves actively testing your controls to produce tangible evidence that they are operating correctly. This verification process is a non-negotiable part of any serious audit readiness checklist, as auditors are trained to look for proof of operation, not just documentation of intent.

Effective control testing turns your compliance framework from a static set of documents into a living, breathing system of verifiable actions. It provides assurance to stakeholders, management, and auditors that risks are being actively managed. Without this step, you are essentially asking an auditor to take your word for it, an approach that rarely ends well.

Why This Is a Critical Step

An unimplemented control is just a sentence on a page. Auditors will systematically test your key controls to confirm they are not merely "shelf-ware." A failure to provide evidence of control operation is a direct finding and can lead to major non-conformities. Demonstrating a rigorous, scheduled testing program shows maturity and a proactive approach to compliance, building significant trust with your auditor.

Practical Implementation Examples

- ISO 27001 (Information Security): A SaaS company performs quarterly tests of its access control systems. They generate a list of all user accounts, cross-reference it with the HR employee roster, and provide documented evidence that all accounts for former employees were disabled within the 24-hour SLA defined in their policy.

- ISO 13485 (Medical Devices): A diagnostics firm samples five production batch records from the previous quarter. They verify that each record contains a complete traceability link from the finished device back to the raw material supplier's Certificate of Analysis, confirming that material verification controls were followed.

- ISO 9001 (Quality Management): A manufacturing plant reviews its quality records for a specific product line. They pull inspection reports and test data to verify that measurements were documented at the required intervals and that any non-conforming products were properly quarantined and recorded according to procedure.

Actionable Tips for Success

- Develop a Test Plan: Create a formal test plan for each critical control. Specify the test frequency, sample size, methodology, and the exact criteria that define a "pass" or "fail."

- Document Test Procedures: Write clear, step-by-step instructions for how to perform each test. This ensures consistency, even if different team members conduct the testing over time.

- Combine Manual and Automated Testing: Use automated tools to continuously monitor system logs, access reports, and security configurations. Supplement this with periodic manual spot-checks and interviews to verify human-centric processes.

- Maintain a Corrective Action Log: When a test fails, document it immediately. Your log should detail the failure, the root cause, the corrective action taken, and the result of re-testing to prove the fix was effective.

- Use Control Monitoring Dashboards: Implement tools that visualize control testing results. Dashboards can help you quickly identify compliance gaps, track remediation progress, and spot negative trends before they become major issues.

5. Training and Competency Assessment Program

A well-documented policy is only as effective as the people who implement it. A formal training and competency assessment program ensures that personnel not only understand their compliance responsibilities but are also capable of performing their roles effectively. This involves a structured approach to initial onboarding, role-specific instruction, and periodic refresher training. This element is a non-negotiable part of any audit readiness checklist because auditors will verify that your team’s knowledge is current and sufficient to maintain the integrity of your management system.

Effective training transforms compliance from a theoretical exercise into an operational reality. It equips employees with the knowledge to handle specific situations, from reporting a security incident to following a quality control procedure. Auditors look for evidence of this program, including training records, materials, and competency assessments, to confirm that your organization has embedded compliance into its culture and daily operations.

Why This Is a Critical Step

An untrained or poorly trained workforce is a significant compliance risk. Human error is a leading cause of control failures, security breaches, and quality deviations. A robust training program demonstrates a proactive commitment to mitigating these risks. When auditors interview staff and find them knowledgeable about relevant policies and procedures, it builds immense confidence in your entire management system. Conversely, employees who are unaware of their responsibilities are a major red flag.

Practical Implementation Examples

- ISO 27001 (Information Security): A financial services company conducts mandatory annual security awareness training for all employees. The program covers phishing recognition, secure data handling, and incident reporting procedures. Completion is tracked via their Learning Management System (LMS), and a short quiz at the end serves as a competency assessment.

- ISO 13485 (Medical Devices): A diagnostics firm provides specialized Good Manufacturing Practice (GMP) training for all production line staff. The training includes hands-on modules on cleanroom protocols and device history record (DHR) documentation. Competency is verified through direct observation by a supervisor before an employee is permitted to work independently.

- ISO 9001 (Quality Management): A manufacturing company trains its process owners on root cause analysis techniques and the proper use of its corrective and preventive action (CAPA) system. Training records are maintained for each process owner, demonstrating they are competent to manage quality within their respective departments.

Actionable Tips for Success

- Create Role-Based Training Matrices: Develop a matrix that maps job roles to specific training requirements based on the controls and processes each person interacts with. This ensures training is relevant and targeted.

- Document Learning Objectives: For each training module, clearly define the learning objectives and map them back to specific clauses or controls in the standard you are being audited against.

- Use Competency Assessments: Go beyond simple attendance tracking. Use quizzes, practical tests, or scenario-based questions to validate that employees have truly understood and can apply the material.

- Maintain Meticulous Records: Keep detailed training logs for every employee, including the date, topics covered, training materials version, and assessment scores. This is crucial audit evidence.

- Include Management: Ensure that managers and leadership participate in and champion the training programs. This reinforces a top-down culture of compliance. You can learn more about building effective compliance training programs on ai-gap-analysis.com.

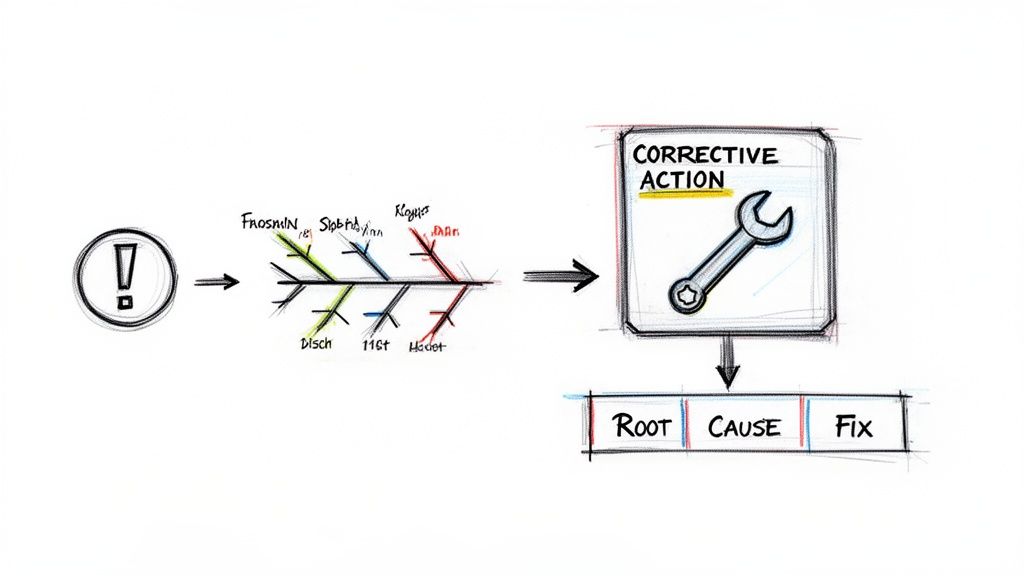

6. Nonconformity and Corrective Action Management

A mature process for managing nonconformities and corrective actions is a clear sign of a healthy, self-improving system. This involves systematically identifying, documenting, investigating, and resolving any deviations from requirements, whether found during internal audits, reported by customers, or flagged in daily operations. Think of it as your organization's immune system; it detects problems, neutralizes them, and learns how to prevent them from happening again. This process is a non-negotiable part of any audit readiness checklist because it proves your commitment to continuous improvement, not just static compliance.

Effective nonconformity management, often called a CAPA (Corrective and Preventive Action) system, transforms issues from liabilities into learning opportunities. It demonstrates to an auditor that you don't just fix what's broken; you understand why it broke and have taken deliberate steps to ensure it won't break again. Without a formal CAPA process, recurring issues are inevitable, and auditors will question the effectiveness of your entire management system.

Why This Is a Critical Step

An organization that cannot effectively address its own mistakes is an organization at risk. Auditors are specifically trained to look for evidence of a functioning CAPA system because it is the primary mechanism for maintaining and improving compliance over time. Ignoring or poorly managing nonconformities suggests a reactive, unstable environment. Conversely, a well-documented CAPA log showing thoughtful root cause analysis and verified corrective actions is compelling evidence of a proactive, controlled, and resilient organization.

Practical Implementation Examples

- ISO 27001 (Information Security): An internal audit finds that quarterly user access reviews for a critical system were missed. The nonconformity is logged, and a corrective action is implemented to automate calendar reminders for the IT manager and require a documented sign-off, which is then reviewed in the next management meeting.

- ISO 13485 (Medical Devices): A customer complaint investigation initially fails to identify the root cause of a device malfunction. The CAPA process mandates a more structured root cause analysis using a fishbone diagram, leading to the discovery of an issue in the sterilization process and a subsequent procedural update and team retraining.

- ISO 9001 (Quality Management): Management review meetings are consistently delayed, a recurring finding. A nonconformity is raised, and the corrective action involves establishing a formal, documented schedule with assigned executive accountability for agenda preparation, ensuring meetings occur as planned.

Actionable Tips for Success

- Maintain a Nonconformity Register: Create a simple log (spreadsheet or GRC tool) to track the issue, date identified, status, responsible party, and target closure date. This provides a single source of truth for all issues.

- Standardize Root Cause Analysis: Use a consistent template (e.g., 5 Whys, Fishbone Diagram) to guide investigations. This ensures every issue is analyzed with the same rigor and prevents superficial fixes.

- Distinguish Containment from Correction: Document both immediate actions to contain the problem (e.g., quarantining a bad batch) and long-term corrective actions to prevent recurrence (e.g., recalibrating machinery).

- Verify Effectiveness: After implementing a corrective action, schedule a follow-up check to gather evidence that the solution worked. Simply closing the ticket is not enough; you must prove the fix was effective.

7. Internal Audit Planning and Execution

An internal audit program is the organization's self-check mechanism, providing an independent assessment of how well compliance controls are actually working. This step involves systematically evaluating your own management system to find and fix deficiencies before an external auditor does. Think of it as a dress rehearsal for the main performance; it identifies weak points in your script and allows you to correct them. This process is a non-negotiable part of any audit readiness checklist because it demonstrates a proactive commitment to continuous improvement.

Executing a structured internal audit transforms compliance from a theoretical exercise into a practiced discipline. It provides management with objective assurance that risk management and internal control processes are operating effectively. Without this internal validation, an organization is essentially flying blind, hoping its documented procedures match its daily reality.

Why This Is a Critical Step

An external audit should never be the first time your controls are tested. Internal audits serve as a critical feedback loop, identifying non-conformities, gaps, and areas for improvement in a low-stakes environment. Uncovering these issues yourself and creating a corrective action plan shows maturity and control, which external auditors view very favorably. Ignoring this step often leads to major non-conformities, as minor issues can fester and grow over time.

Practical Implementation Examples

- ISO 27001 (Information Security): A SaaS company conducts an annual internal audit covering all key information security controls. The audit includes testing employee access reviews, verifying the effectiveness of the incident response plan through a tabletop exercise, and checking physical security measures at their data center.

- ISO 13485 (Medical Devices): A medical device firm schedules semi-annual internal audits focused on high-risk processes like design controls, sterilization validation, and complaint handling. The audit team verifies that all steps in the Quality Management System (QMS) are followed and documented correctly.

- ISO 9001 (Quality Management): A manufacturing business performs quarterly audits on different departments. One quarter they might audit the production line's adherence to work instructions, and the next they audit the sales process to ensure customer requirements are properly captured and communicated.

Actionable Tips for Success

- Develop a Risk-Based Audit Plan: Create an annual audit schedule that prioritizes high-risk areas. Critical processes like change management or supplier qualification may require more frequent audits than lower-risk administrative functions.

- Create Detailed Audit Checklists: For each audit, develop checklists that map directly to the framework's requirements. This ensures comprehensive coverage and provides a structured way to record observations and gather evidence.

- Train Your Internal Auditors: Equip your audit team with skills in objective evidence gathering, interviewing techniques, and root cause analysis. They must be independent of the area they are auditing to ensure impartiality.

- Document Findings Rigorously: Clearly document all findings, classifying them as observations, minor non-conformities, or major non-conformities. Each finding should be supported by specific evidence (e.g., "Log file X from server Y was missing for the period of June 1-5").

- Integrate Findings into a Corrective Action System: Ensure that every identified non-conformance is logged into a formal Corrective Action Request (CAR) system. Track each CAR through root cause analysis, correction, and verification of effectiveness.

8. Audit Response Preparation and Documentation

While preparing evidence is proactive, your ability to respond to auditor inquiries during the audit is equally crucial. Audit response preparation involves creating a structured process for handling auditor requests, documenting interactions, and formulating clear, evidence-backed answers. This is the real-time test of your audit readiness checklist, where your organized evidence library is put into action. Think of it as the courtroom phase; you've gathered all your evidence, and now you must present it clearly and convincingly when questioned.

Effective response management demonstrates control, transparency, and respect for the audit process. It ensures that answers are consistent, timely, and directly address the auditor's query, preventing misunderstandings and unnecessary follow-ups. A disorganized, slow, or incomplete response can create an impression of chaos, even if the underlying controls are strong.

Why This Is a Critical Step

An audit is a dialogue, not just a document review. How you communicate and respond shapes the auditor's perception of your organization's competence. A well-managed response process minimizes friction, builds trust, and allows you to control the narrative. Failing to prepare for this interactive phase can turn a straightforward request into a frantic scramble, undermining the auditor's confidence and potentially leading to non-conformities based on perceived disorganization.

Practical Implementation Examples

- ISO 27001 (Information Security): During a Stage 1 audit, a fintech company receives a pre-audit questionnaire. Their designated audit coordinator uses a response log to assign each question to a subject matter expert, collects the answers and supporting documents (e.g., risk assessment methodology, Statement of Applicability), and submits a single, professionally formatted package back to the auditor within the specified timeline.

- ISO 13485 (Medical Devices): An auditor on-site requests evidence of supplier qualification for a critical component. The quality manager quickly retrieves the supplier audit report, qualification certificate, and incoming inspection records from their QMS, referencing the exact document IDs in their verbal and written response.

- ISO 9001 (Quality Management): When an auditor questions the effectiveness of a corrective action, the operations manager presents the completed Corrective Action Report (CAR), which includes the root cause analysis, implementation evidence (e.g., revised work instruction, training records), and post-implementation effectiveness check data.

Actionable Tips for Success

- Assign an Audit Response Coordinator: Designate a single point of contact to manage all auditor requests. This individual logs questions, tracks deadlines, coordinates with internal teams, and ensures all responses are reviewed before submission.

- Create an Auditor Request Log: Use a simple spreadsheet or a GRC tool to document every request, who it was assigned to, the response provided, the evidence linked, and the date of submission. This creates a complete record of audit interactions.

- Use Response Templates: Prepare a standard template for written responses that includes sections for the auditor's observation, your organization's response, direct links or references to supporting evidence, and root cause analysis (if addressing a finding).

- Review Responses Before Submission: Have a second person, such as a quality manager or compliance lead, review all responses for accuracy, clarity, and tone. Ensure the evidence provided directly and fully answers the auditor's question.

Audit Readiness: 8-Point Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases ⭐ | Key Advantages 💡 |

|---|---|---|---|---|---|

| Document Collection and Evidence Management | Moderate — set up repository, metadata, versioning | Low–Medium — storage, DMS, occasional maintenance | Faster auditor queries; complete evidence chains | Centralizing audit evidence for multi-framework compliance | Rapid retrieval, version control, reduced audit time |

| Gap Assessment Against Compliance Frameworks | Medium–High — mapping controls and scoring readiness | Medium — SME time, tools or AI for analysis | Prioritized gaps, readiness scores, remediation roadmap | Pre-audit readiness and multi-certification planning | Data-driven prioritization; reduces surprise findings |

| Policy and Procedure Documentation Review | Medium — cross-functional reviews and alignment | Medium — policy owners, review cycles, editing tools | Policies aligned to requirements and practice | Updating governance documents before audits | Clear expectations, supports training and consistency |

| Control Implementation and Testing Verification | High — technical testing, sampling, and validation | High — testers, system access, monitoring tools | Evidence of operating effectiveness; fewer findings | High-risk controls and post-deployment validation | Detects failures early; provides operational proof |

| Training and Competency Assessment Program | Medium — design curricula and assessment processes | Medium — trainers/LMS, recordkeeping, assessment tools | Demonstrable staff competency and training records | Role-based compliance and dispersed teams | Reduces human error; shows due diligence to auditors |

| Nonconformity and Corrective Action Management | Medium — investigation, root-cause, CAPA workflows | Medium — CAPA system, owners, verification resources | Closed findings, systemic improvements, trend metrics | Remediation after audits and recurring issues | Prevents repeat findings; documents corrective evidence |

| Internal Audit Planning and Execution | High — risk-based planning, objective execution | Medium–High — trained auditors, time from functions | Early gap detection; management oversight evidence | Ongoing assurance and external audit preparation | Identifies issues proactively; reduces external scope |

| Audit Response Preparation and Documentation | Medium — rapid coordination and evidence linking | Medium — response coordinator, access to docs, reviewers | Timely, evidence-backed responses; fewer follow-ups | Active external audits and addressing draft findings | Faster turnaround; consistent professional communication |

From Checklist to Continuous Compliance: Your Next Steps

Navigating the intricate landscape of an audit can feel like preparing for a final exam. You have studied the material, organized your notes, and practiced your responses. The comprehensive audit readiness checklist we have detailed, from rigorous document collection and gap assessments to proactive internal audits and response preparation, serves as your definitive study guide. Completing these eight critical steps is a monumental achievement, signaling a deep commitment to quality, security, and operational excellence.

However, the ultimate goal isn't just to pass the exam; it is to master the subject matter so profoundly that you are always prepared for any test, at any time. True audit readiness transcends the cyclical scramble of pre-audit preparation. It evolves into a state of continuous compliance, where audit-proof practices are woven into the very fabric of your daily operations. This shift transforms your approach from a reactive, project-based sprint into a proactive, ingrained cultural mindset.

Key Takeaways: From Static Tasks to Dynamic Processes

The most crucial takeaway is that each item on the checklist represents a living, breathing process, not a static, one-and-done task. Let's reframe the core concepts to highlight this evolution:

- Document Management is Evidence Lifecycle Management: Instead of a frantic hunt for documents, envision a system where evidence is automatically captured, linked to specific controls, and maintained with a clear version history.

- Gap Assessments Become Real-Time Monitoring: Rather than a periodic and labor-intensive review, your gap analysis should be a dynamic dashboard that constantly monitors your compliance posture against frameworks like ISO 27001, ISO 13485, or ISO 9001.

- Internal Audits Fuel Continuous Improvement: Move beyond viewing internal audits as a mere dress rehearsal. They are your primary mechanism for iterative improvement, identifying minor deviations before they escalate into major nonconformities.

This transition from a static checklist to a dynamic compliance engine is the hallmark of a mature, resilient organization. It is what separates companies that merely survive audits from those that leverage them as a strategic advantage to build trust, enhance efficiency, and drive sustainable growth.

Your Actionable Path Forward

So, where do you go from here? The first step is to internalize this new perspective. Treat your audit readiness checklist not as a finish line, but as the blueprint for building a perpetual compliance machine. Start by identifying the most manual, time-consuming, and error-prone processes in your current audit preparation cycle. Is it tracking corrective actions? Or perhaps it is the painstaking process of manually mapping evidence to hundreds of controls?

Key Insight: The biggest bottleneck in audit readiness is almost always the manual effort required to locate, verify, and link evidence to specific compliance requirements. Solving this single problem can unlock hundreds of hours and dramatically increase your confidence.

This is where modern technology becomes an indispensable ally. Manually sifting through thousands of documents, emails, and system logs to find a single piece of evidence is an outdated and inefficient strategy. It introduces unacceptable risks and drains your most valuable resource: your team's time. By embracing automation, you can transform this challenge into a core strength. Platforms leveraging AI can automate evidence discovery, maintain a real-time, evidence-linked view of your controls, and provide an unparalleled level of assurance. This frees your team to focus on strategic improvements rather than administrative burdens, ensuring you are not just ready for the audit, but always ready.

Ready to transform your static documents into a dynamic, audit-ready compliance engine? Discover how AI Gap Analysis automates evidence discovery and provides an instant, evidence-linked view of your compliance posture against any framework. Stop chasing documents and start building a culture of continuous readiness today with AI Gap Analysis.