January 17, 2026

compliance and risk assessmentrisk management frameworksGRC strategyISO 27001 auditcompliance automation

A Practical Guide to Compliance and Risk Assessment

Master compliance and risk assessment with this practical guide. Learn to navigate frameworks, avoid common pitfalls, and leverage AI to protect your business.

22 min readAI Gap Analysis

Let’s start with an analogy. Think of your business as a high-performance car. Compliance is the regular maintenance you do—checking the oil, rotating the tires, and making sure your car passes its annual inspection. It's all about meeting the established rules of the road.

Risk assessment, on the other hand, is when a master mechanic hooks your car up to a diagnostic machine to look for hidden problems. They’re not just checking if you meet today’s standards; they’re trying to spot potential engine trouble before you end up stranded on the side of the highway.

One is about following the rules, the other is about anticipating problems. You need both to keep your organization running smoothly and safely.

What Are We Really Talking About?

At its heart, compliance is simply the act of following the rules. These might be external laws from governments (like GDPR or HIPAA), industry standards you’ve chosen to adopt (like ISO 27001), or even your own internal company policies. The main job here is to meet those specific requirements and have the proof to back it up.

Risk assessment is a completely different beast. It’s a proactive, forward-looking exercise. The goal is to identify, analyze, and weigh the potential threats that could derail your business. It’s less about checking boxes and more about asking, "What could realistically go wrong, and what would we do about it?"

While they seem different, they’re actually two sides of the same coin. A solid compliance program naturally lowers your risk of facing fines or legal action. And a good risk assessment will almost always shine a light on where your compliance controls are weak, giving you a roadmap for improvement.

Why This is No Longer Optional

The regulatory landscape has become a minefield. A recent study found that a whopping 85% of organizations feel their compliance obligations have become much more complex. That number jumps even higher in heavily regulated sectors like financial services (90%) and healthcare (84%).

This isn't just a feeling; it's a reality driven by a constant stream of new laws, fast-moving technology, and a huge focus on data privacy and cybersecurity—which over half of executives now see as their biggest compliance risks. You can dive deeper into these trends in PwC's 2025 Global Compliance Survey.

What this all means is that getting a firm grip on both compliance and risk is no longer a "nice-to-have." It’s fundamental to your company's survival.

I see a lot of teams make the same mistake: they treat compliance like a one-and-done project. But it's not a finish line. It's a continuous cycle that has to be fed by ongoing risk assessment. Your risks are always changing, so your compliance activities must change with them.

To make the distinction crystal clear, here’s a quick breakdown of how these two functions differ and where they overlap.

Compliance vs Risk Assessment at a Glance

This table helps put the primary goals, focus, and outcomes of each discipline side-by-side.

| Aspect | Compliance | Risk Assessment |

|---|---|---|

| Primary Goal | To meet specific, established rules and standards. | To identify and evaluate potential future threats. |

| Focus | Retrospective and current state (Are we following the rules now?) | Forward-looking and predictive (What could go wrong?) |

| Driver | External laws, regulations, standards, and internal policies. | Business objectives, assets, vulnerabilities, and threats. |

| Outcome | Evidence of adherence, audit reports, and certifications. | A prioritized list of risks and a risk treatment plan. |

Ultimately, compliance gives you the framework, while risk assessment provides the context, ensuring your efforts are focused on the threats that truly matter.

Navigating Key Frameworks Like ISO 27001

So you've grasped the interplay between compliance and risk. Now, it's time to pick your map. Compliance frameworks are essentially structured roadmaps that lay out a path toward operational excellence, security, and quality. Think of them as the internationally recognized rulebooks for getting it right.

It helps to see them as blueprints for building a house. One might be for a hurricane-proof coastal home, another for an energy-efficient mountain cabin. Each solves a specific problem, but they all share foundational principles—a solid foundation, a sturdy roof. In the same way, frameworks like ISO 27001, ISO 13485, and ISO 9001 address different business challenges but are all built on shared ideas of structure and control.

These standards aren't just about earning a certificate to hang on the wall. They are powerful tools for building trust, taming complex operations, and fostering a culture of continuous improvement. For any GRC team or auditor, knowing which framework to apply—and why—is the first real step toward building a resilient compliance program.

The Fortress for Your Data: ISO 27001

In today's economy, a company's data is often its most valuable asset. ISO 27001 is the global standard for building an Information Security Management System (ISMS), and its entire purpose is to give you a systematic way to keep sensitive information locked down.

This isn't just for tech companies. Any organization that handles valuable data—from banks to hospitals—stands to benefit. At its core, the framework pushes you to:

- Systematically examine your information security risks by looking hard at threats, vulnerabilities, and their potential impact.

- Design and implement a full suite of security controls tailored to address those specific risks.

- Adopt an overarching management process to make sure those controls stay effective and relevant over time.

Achieving ISO 27001 certification sends a clear message to clients and partners: you have a robust, audited system in place to protect their data. That's a serious competitive advantage. For a closer look at the risk side of the equation, our guide on a complete cybersecurity risk assessment offers insights that tie directly into these principles.

The Gold Standard for Medical Devices: ISO 13485

When a product failure can affect someone's health, the standards for quality are non-negotiable. ISO 13485 is the framework built specifically for the medical device world. It defines the requirements for a quality management system (QMS) that spans a device's entire lifecycle, from the initial design sketch to production and post-market monitoring.

This standard is absolutely critical for anyone in the sector—designers, manufacturers, and suppliers alike. It places a heavy emphasis on:

- Traceability: The ability to track every single component and process from its origin right through to the finished product.

- Risk Management: Weaving risk-based thinking into every decision throughout the product’s life.

- Regulatory Compliance: Ensuring you meet the strict legal demands of global markets.

For QA and regulatory leads, ISO 13485 is the definitive blueprint for ensuring patient safety and product effectiveness. It’s not just a best practice; in major regions like Europe and Canada, it's a ticket to entry.

The Universal Blueprint for Quality: ISO 9001

While other standards zero in on specific industries, ISO 9001 is the world’s most recognized standard for quality management systems, period. It’s designed to work for any organization, no matter its size or what it does. The core goal is simple: help you consistently deliver products and services that meet customer expectations and regulatory requirements.

ISO 9001 is about making promises and keeping them. It formalizes your commitment to quality by ensuring your processes are defined, controlled, and consistently improved, which builds unshakable customer trust.

The framework is built on a handful of key principles, including a sharp customer focus, direct involvement from top management, a process-based approach, and a real commitment to continual improvement. For anyone leading operations, implementing ISO 9001 translates into more efficient workflows, less waste, and happier customers. It provides a flexible yet powerful foundation that other, more specific standards can easily build upon.

Building an Effective Risk Assessment Workflow

A structured workflow is what turns risk assessment from a theoretical box-ticking exercise into a practical, decision-making engine for your business. It’s the blueprint that helps you figure out what could go wrong, understand the potential fallout, and put your money and people where they’ll make the biggest difference.

Let’s walk through building one from scratch. Imagine we're a fintech startup responsible for safeguarding sensitive user data—the stakes don't get much higher. A clear process is the only way to move from constantly putting out fires to proactively managing risk. It creates a straight line from a potential threat to a concrete action plan, which is really the foundation of any mature compliance program.

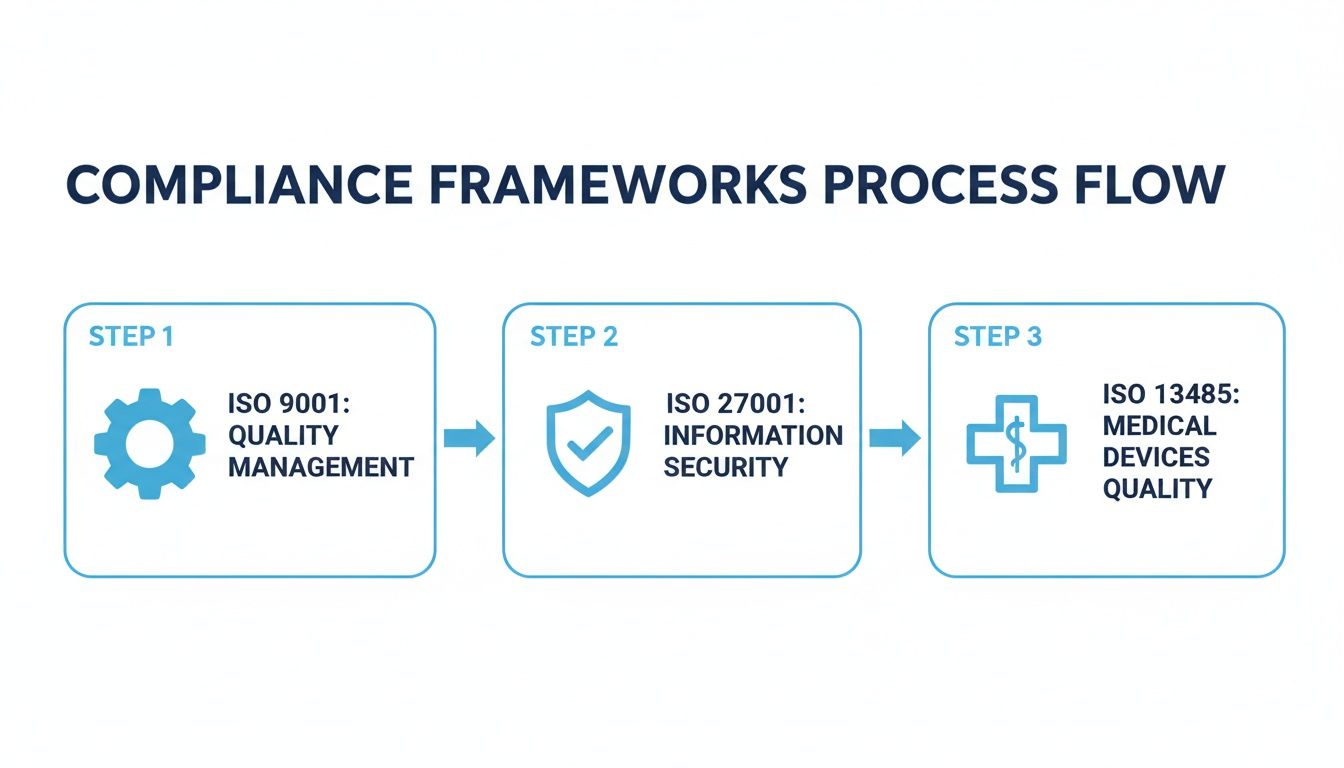

This diagram shows how different frameworks, each with its own focus, all plug into a cohesive risk management strategy.

You can see the flow from broad quality management (ISO 9001) to the specifics of information security (ISO 27001) and even into highly specialized fields like medical devices (ISO 13485). It's a great illustration of how core risk principles are adapted to fit different business needs.

Step 1: Identify Your Critical Assets

First things first: you can't protect what you don't know you have. For our fintech startup, the "assets" aren't just servers and laptops. They're the very things that deliver value to customers and, by extension, carry the most risk.

The goal here is to build an inventory. This means getting department heads in a room and listing everything from the tangible to the intangible.

- Data Assets: This is the big one. We're talking about customer Personally Identifiable Information (PII), transaction histories, and financial account details—the crown jewels.

- Technology Assets: Think about the core infrastructure. This includes the cloud environment, the mobile app your customers use, and all the internal databases that make it run.

- People Assets: The human element is often overlooked. Your lead database administrator or the head of fraud prevention are critical assets. If they’re suddenly unavailable, it could cause serious disruption.

- Reputational Assets: A company’s brand and the trust it has built with users is a vital, if intangible, asset. One bad data breach could wipe it out overnight.

Step 2: Analyze Threats and Vulnerabilities

Once you have a clear picture of your assets, the next step is to figure out what could harm them. It’s important to distinguish between two key terms. A threat is an external event that could cause damage (like a ransomware attack), while a vulnerability is an internal weakness that a threat could exploit (like unpatched software).

For our fintech example, a few pairs might look like this:

- Threat: A sophisticated phishing campaign targets employees who have access to production systems.

- Vulnerability: Your internal admin panels don't have mandatory multi-factor authentication (MFA).

- Threat: A malicious insider tries to steal and sell customer data.

- Vulnerability: Your database access logs are spotty and aren't actively monitored.

This part of the process requires you to think like an attacker. Where are our weakest points? What are the most attractive targets? This is how you connect abstract dangers to tangible weaknesses in your defenses.

Step 3: Score and Prioritize Risks

Let's be realistic—not all risks are created equal, and you don't have unlimited resources. To spend your time and budget wisely, you need a system to score and rank them. This usually comes down to evaluating two factors for each risk you’ve identified: Likelihood (how probable is it that this will actually happen?) and Impact (if it does happen, how bad will it be?).

These factors are often rated on a simple scale, like 1 (Low) to 5 (High). You then multiply the two values to get a clear score: Risk Score = Likelihood x Impact. This simple formula is powerful because it helps turn subjective worries into objective priorities.

A risk heatmap is the visual result of this exercise. It plots risks on a grid, with likelihood on one axis and impact on the other. High-score risks in the top-right corner (often colored red) immediately draw attention and demand action.

This visualization is an incredibly effective communication tool for leadership. It instantly shows where the biggest dangers are without anyone needing to be a security expert. It helps drive strategic conversations about what level of risk is acceptable. Focusing on objective scoring is key, as 94% of organizations say risk assessment is their top priority, even more so than data breaches (85%) or reputational harm (83%). You can dive deeper into these trends and see how 76% of companies are using technology to improve their assessments in recent compliance statistics reports.

Here’s a simplified look at how those numbers come together in a scoring matrix.

Risk Scoring Matrix Example

This table shows a basic framework for turning Likelihood and Impact ratings into a clear, prioritized risk level.

| Likelihood | Impact Level | Risk Score (Likelihood x Impact) | Risk Level |

|---|---|---|---|

| 5 (Very High) | 5 (Critical) | 25 | Critical |

| 4 (High) | 4 (Major) | 16 | High |

| 3 (Medium) | 3 (Moderate) | 9 | Medium |

| 2 (Low) | 2 (Minor) | 4 | Low |

| 1 (Very Low) | 1 (Insignificant) | 1 | Very Low |

By plotting these scores, you can quickly see which risks (like the 25-point "Critical" one) need immediate attention versus those that can be managed over time.

Step 4: Document and Treat the Risks

The final—and most important—step is to formalize your findings and build an action plan. This usually results in two essential documents:

- The Risk Register: Think of this as your master log of all identified risks. It should be a living document that details the risk itself, the asset it affects, the threat/vulnerability pair, its scores, the overall risk level, and who on the team "owns" it.

- The Risk Treatment Plan: This document answers the question, "So what are we going to do about it?" For each high-priority risk, you'll outline your response. There are generally four ways to handle a risk:

- Mitigate: Implement controls to reduce the risk's likelihood or impact (e.g., finally rolling out that MFA).

- Transfer: Shift the financial burden of the risk to a third party (e.g., buying a comprehensive cybersecurity insurance policy).

- Accept: Formally acknowledge the risk and decide to do nothing. This is typically reserved for low-score risks where the cost of fixing it is higher than the potential loss.

- Avoid: Stop doing the activity that's causing the risk (e.g., decommissioning an old, insecure server that's no longer needed).

Following a structured workflow like this ensures that every compliance and risk assessment is thorough, defensible, and directly connected to real actions that make the business safer.

Avoiding Common Compliance and Risk Pitfalls

Even with the best intentions, a compliance program can easily go off the rails. I’ve seen it happen time and again. Teams get tripped up by the same predictable mistakes, turning a strategic function into a stressful, last-minute fire drill. Knowing what these hurdles are is the first step to building a program that holds up under pressure.

The biggest mistake? Treating compliance like a one-and-done project. It’s a “finish line” mentality. Teams scramble to pass an audit, breathe a sigh of relief, and then stick the whole program on a shelf until the next one looms. This completely misses the point that risk is always in motion. Your business changes, threats evolve, and regulations shift.

Effective compliance isn’t a destination you arrive at; it's a continuous cycle of assessment, remediation, and monitoring. Adopting this mindset shifts your program from a reactive cost center to a proactive strategic advantage that protects the business year-round.

Thinking in cycles keeps your compliance and risk assessment efforts sharp and relevant, not just a dusty binder of old policies.

Ditching the Generic Checklist

Another classic misstep is leaning too heavily on generic, off-the-shelf checklists. Sure, a template can give you a starting point, but it will never capture the unique context of your business. Your specific tech stack, your operational workflows, the kind of data you handle—all of this creates a risk profile that a generic checklist is guaranteed to miss, leaving you with dangerous blind spots.

Think about it: a healthcare provider and a financial services firm both need to protect sensitive data, but the specific threats they face and the rules they have to follow are worlds apart. You have to tailor your assessment to your reality. It's simply not optional for managing risk effectively.

The Chaos of Disorganized Evidence

Nothing causes more panic on audit day than a messy trail of evidence. When an auditor asks for proof that a control is working, the last thing you want is a frantic search through scattered shared drives, endless email threads, and old spreadsheets. That scavenger hunt doesn't just waste a ton of time; it sends a clear signal to the auditor that your processes are out of control.

This disorganization is a huge risk in itself. If you can't produce the evidence when asked, you could fail the audit—even if the control was working perfectly. A central, organized system for collecting and managing evidence is the bedrock of any solid compliance program. Common signs of trouble include:

- Scattered Documentation: Policies, procedures, and reports live in a dozen different, disconnected places.

- Lack of Version Control: Nobody is sure which document is the current one, leading to confusion and the risk of showing an auditor something outdated.

- No Clear Ownership: It’s unclear who is responsible for keeping critical compliance documents maintained and up to date.

Overcoming Silos and Securing Buy-In

Finally, a lot of programs stumble because they’re run in a silo. Compliance isn't just an IT problem or a legal problem; it's a business-wide responsibility. When you conduct risk assessments without talking to people in HR, operations, or finance, you end up with an incomplete and inaccurate picture of your real risks.

This siloed approach is usually a symptom of not having real buy-in from leadership. If the C-suite sees compliance as just another bureaucratic headache, they won’t dedicate the resources or champion the cross-departmental teamwork needed to get it right.

The key is to frame the compliance and risk assessment process in business terms. Talk about how a strong program cuts down on financial risk, builds trust with customers, and can even become a competitive advantage. When you connect compliance work directly to business goals, you’ll get the top-down support you need to break down those silos and build a program that actually works.

Streamlining Audits with AI and Automation

Let’s be honest: manual compliance processes are struggling to keep up. Teams are drowning, spending hundreds of hours sifting through documents, cross-referencing policies, and trying to map evidence to specific controls. It’s not just slow and tedious—it’s a recipe for human error and injects a massive amount of stress into every audit cycle.

Thankfully, we're at a turning point. The next step in compliance and risk assessment involves using AI and automation to turn these administrative nightmares into a strategic advantage. This isn't about replacing your expertise. It’s about supercharging it, freeing your team to focus on meaningful analysis instead of getting bogged down in clerical work.

The AI-Powered Compliance Workflow

Imagine you no longer have to manually scan a 200-page policy document just to find that one sentence an auditor is asking for. Instead, you upload your entire evidence library—all your policies, procedures, and reports—and let an AI-driven platform do the heavy lifting for you.

This is exactly how modern tools are flipping the script on the audit process. They use sophisticated language models to understand the content and context of your documents, instantly drawing connections between your internal controls and the requirements of standards like ISO 27001 or ISO 13485.

The real win here is speed and precision. An AI can parse thousands of pages in minutes, pulling out the exact evidence needed and providing direct links to the source. This transforms the entire process from a frustrating scavenger hunt into a state of continuous audit readiness.

This isn't just a niche trend; it's quickly becoming the new industry standard. The 2025 Global Compliance Risk Benchmarking Survey from White & Case shows that AI adoption is accelerating. Over half of organizations are now using or piloting AI for risk assessment, a massive jump from just 30% in 2023. What's driving this? The fact that 58% of companies face four or more audits each year, making the old manual methods completely unsustainable.

From Evidence Extraction to Audit Readiness

AI-powered platforms do more than just find text; they organize it for immediate action. They can automatically populate gap analysis reports, map your existing controls to new frameworks, and pinpoint exactly where your evidence is weak or missing.

Here’s how this automated workflow solves some of the most common headaches:

- Evidence Extraction: The system intelligently analyzes your documents to find relevant statements, controls, and procedures, which means you can stop wasting time on manual searches.

- Gap Mapping: It instantly compares your documented controls against standard requirements, flagging non-conformities and other areas that need your attention.

- Collaboration: GRC, QA, and regulatory teams can all work in a single, secure space to comment on findings and assign remediation tasks with the full context right there.

- Audit-Ready Reporting: The platform generates clean, comprehensive reports with all the evidence neatly cited and linked—something you can hand directly to an auditor.

This kind of technology moves teams from the drudgery of manual review to a system that provides actionable, pre-analyzed results. To get a better handle on this new reality, check out our detailed guide on conducting an audit risk assessment.

By embracing these tools, companies don't just speed up their audits. They build a more accurate, resilient, and continuously monitored compliance program, allowing human judgment to stay where it belongs: at the center of strategic decision-making.

Your Actionable Implementation Checklist

Knowing the theory is one thing, but putting it into practice is what makes or breaks a compliance program. This checklist is your roadmap for getting it done, whether you're starting from scratch or giving your existing process a much-needed overhaul. Think of it as a step-by-step guide to make sure nothing important falls through the cracks.

The trick is to build a solid foundation first and then add layers of process and technology on top. Each step here is designed to help you create a compliance posture that’s strong, ready for an audit, and actually helps the business instead of getting in the way.

Phase 1: Foundational Steps

Before you even think about frameworks or software, you need to set the stage. Getting these first few steps right is absolutely critical—it saves you from massive headaches and rework later on.

- Define Your Scope: Get crystal clear on what's in and what's out. Which business units, regulations, and systems are you covering? Is this for the whole company or just a new product line? The more specific you are now, the better.

- Secure Executive Buy-In: You need leadership in your corner. This isn't just about avoiding trouble; it's about business value. Frame your pitch around mitigating fines, closing bigger deals, and protecting the company's reputation. Their support is non-negotiable if you want the budget and authority to succeed.

- Assemble a Cross-Functional Team: Compliance isn’t just a one-person show. Pull in people from IT, Legal, HR, and Operations right from the start. This breaks down silos and gives you a complete picture of the risks you're facing.

Phase 2: Execution and Tooling

Okay, with your foundation poured, it's time to start building. This phase is all about the "how"—the hands-on work of assessing risk and picking the right tools for the job.

- Select Relevant Frameworks: Pick the standards that actually matter to your business. Maybe that's ISO 27001 for security, or ISO 13485 if you're in the medical device world. Don't just collect certifications; choose what adds value.

- Choose Your Toolset: Are you going to wrestle with spreadsheets, or are you ready for a dedicated platform? AI-powered tools like AI Gap Analysis can be a game-changer, automating the painful parts of evidence gathering and analysis.

- Conduct the Initial Assessment: It's time to roll up your sleeves. Follow your workflow to identify assets, figure out what could go wrong, and score the risks. If you need a deeper dive on getting ready, our detailed audit readiness checklist is a great resource.

The goal here isn't just to survive an audit. It's about building a program that lasts. Make sure you have a set schedule for reviewing your risk register—at least once a year, or anytime the business goes through a major change.

Phase 3: Measurement and Improvement

You can't fix what you don't measure. Setting up the right metrics is the only way to track your progress, prove the value of your work, and create a culture that’s always getting better.

Here are a few key metrics to keep an eye on:

- Time to Audit Readiness: How long does it take your team to get all the evidence together for an audit? The faster, the better.

- Number of Remediated Risks: Are you actually closing out the high-priority risks you find? Track that closure rate.

- Reduction in Audit Findings: The ultimate proof. Are you seeing fewer non-conformities audit over audit?

By following this checklist, your team can finally get out of that reactive, fire-fighting mode and start managing compliance and risk with a real strategy.

Common Questions We Hear

Even with a solid grasp of the theory, a few practical questions always pop up when it's time to get a compliance and risk assessment program off the ground. Here are some of the most common ones we hear from auditors, GRC teams, and QA leads, along with some straight-to-the-point answers.

How Often Should My Company Conduct a Risk Assessment?

The simple answer is at least once a year. That’s the baseline.

But the real answer is that risk assessment isn't a once-a-year event; it’s a living process. You should absolutely trigger a fresh assessment whenever something significant changes. Think about things like adopting a major new piece of technology, launching into a new market, a big regulatory shift, or, of course, after a security incident.

The goal is to move toward a state of continuous risk management. In fast-moving or high-risk industries, we often see teams moving to quarterly reviews to stay ahead of the curve.

What’s the Difference Between a Risk Assessment and a Gap Analysis?

This is a great question, and it's easy to see why they get confused. They’re related, but they do two different jobs.

A risk assessment is all about looking for potential threats and weak spots that could harm your business. The end result is a prioritized list of risks based on how likely they are to happen and how much damage they could do.

A gap analysis, on the other hand, is more like holding up a mirror. It compares what you’re currently doing against the specific rules of a standard like ISO 27001. It points out exactly where you're falling short. A gap analysis is a fantastic starting point for a risk assessment because every "gap" you find is a potential risk you need to evaluate.

Here’s a simple way to think about it: A gap analysis tells you if you've installed all the required smoke detectors (compliance). A risk assessment tells you where a fire is most likely to start (risk).

How Can I Get Executive Buy-In for Our Compliance Program?

Getting leadership to sign off means speaking their language—the language of business value, not technical checklists.

Shift the conversation away from ticking boxes and focus on the strategic wins. You have to paint a clear picture of the return on investment (ROI). Start by highlighting the massive costs of getting it wrong: the fines, the legal battles, and the reputational hit that can take years to recover from.

Then, flip the script and position compliance as a business enabler. Explain how certifications like ISO 27001 aren't just a cost center; they’re a key that unlocks deals with big enterprise clients who won't work with anyone less secure.

Finally, show them how modern tools and automation can slash the manual labor costs, make the whole operation more efficient, and give you a real edge over the competition. When you directly connect a strong compliance and risk assessment program to the bottom line, getting that "yes" becomes a whole lot easier.

Ready to turn your audit process from a manual headache into a strategic advantage? AI Gap Analysis uses AI to automatically pull evidence, map gaps, and create audit-ready reports in minutes, not weeks. See how AI Gap Analysis can sharpen your compliance workflow today.