January 29, 2026

what is a compliance programcompliance programrisk managementISO 27001audit readiness

What Is a Compliance Program and How Do You Build One?

Learn what is a compliance program, its core components, and how to build one from the ground up to improve governance and ensure audit readiness.

23 min readAI Gap Analysis

At its core, a compliance program is your company's playbook for playing by the rules. It's the collection of internal policies, day-to-day procedures, and cultural norms you establish to make sure you're operating legally, ethically, and in line with industry standards.

But it’s so much more than a simple rulebook. Think of it as a strategic framework that helps you prevent, spot, and handle any potential violations before they become major problems. It's not just about dodging fines; it’s a fundamental part of building a resilient business that people trust.

Defining Your Modern Compliance Program

When people hear "compliance program," they often imagine a dusty binder full of legal jargon shoved on a shelf to appease auditors. That outdated view misses the point entirely. A truly effective program is a living, breathing part of your organization.

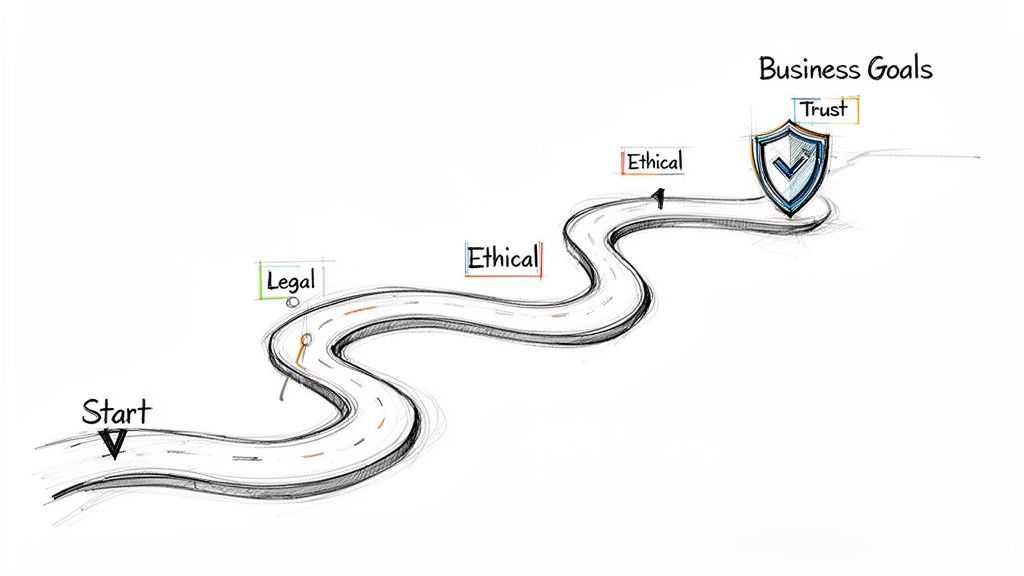

It acts like a navigation system, guiding every team toward shared business goals while steering clear of legal potholes and reputational cliffs. And it's never a one-size-fits-all template. A great program is shaped by your specific industry, risks, and operations—whether that means following GDPR for data privacy, meeting OSHA safety standards, or adhering to anti-corruption laws. The real goal is to weave compliant and ethical behavior into the very fabric of your company culture.

Beyond a Simple Rulebook

A modern compliance program isn't about reacting to problems; it's about proactively building a better, safer business. By standardizing processes and making expectations crystal clear, it creates an environment where everyone feels empowered to make the right choices.

This turns compliance from a dreaded checklist into a genuine business asset:

- It builds trust: When customers, partners, and employees see a real commitment to doing things the right way, their confidence soars. A solid program is a powerful signal of your company's integrity.

- It improves efficiency: Clear rules and standardized workflows cut through ambiguity, reduce errors, and help your operations run more smoothly.

- It protects the brand: It can take decades to build a great reputation and only one compliance slip-up to tear it down. A robust program is your best defense against that kind of damage.

A well-structured compliance program serves as a strategic guide, helping your team navigate complex requirements while upholding organizational values. Without such a framework, the risk of legal infringements increases significantly.

To better understand its multifaceted role, here’s a quick breakdown of a compliance program's key functions.

Core Functions of a Compliance Program at a Glance

| Function | Objective | Business Impact |

|---|---|---|

| Risk Mitigation | Identify, assess, and reduce legal, financial, and reputational risks. | Protects assets, prevents financial loss, and safeguards brand reputation. |

| Operational Guidance | Standardize procedures and provide clear guidelines for employee conduct. | Increases efficiency, reduces errors, and ensures consistent quality. |

| Ethical Culture | Promote a culture of integrity, accountability, and transparency. | Boosts employee morale, attracts top talent, and builds stakeholder trust. |

| Regulatory Adherence | Ensure the organization follows all applicable laws, regulations, and standards. | Avoids penalties, fines, and legal action while enabling market access. |

Each of these functions works together to create a stronger, more dependable organization from the inside out.

A Foundation for Growth

Ultimately, a compliance program isn't a business constraint; it's a launchpad for sustainable growth. It creates the stable, trustworthy foundation needed to scale your operations, confidently enter new markets, and forge lasting relationships with stakeholders.

For example, a company pursuing ISO 9001 certification relies on its compliance program to prove its commitment to quality management. A health-tech startup uses its HIPAA compliance program to reassure customers that sensitive patient data is handled with the utmost care.

In both cases, compliance isn't a roadblock—it's what makes their business possible. Embracing this mindset is the first step in turning what many see as a cost center into a powerful competitive advantage.

The Seven Pillars of an Effective Compliance Program

A solid compliance program isn't just a binder on a shelf or another department down the hall. It’s a living, breathing system made up of connected parts. Think of it like building a structure—it needs several strong pillars to hold it up. If one weakens, the whole thing becomes unstable.

To build a program that truly works—one that satisfies regulators and makes your business stronger—you need to understand these seven pillars. They each do a specific job, but they all work together to build a culture of integrity that runs through everything you do.

Pillar 1: Governance and Oversight

Everything starts at the top. Governance and Oversight is all about leadership commitment. Without real, tangible buy-in from the board and senior executives, any compliance effort is pretty much dead on arrival. Leaders can't just sign off on a budget; they have to actively champion the program and live its values.

This is what people mean by setting the "tone at the top." It's about making ethical conduct visible and non-negotiable. This pillar also covers appointing a dedicated compliance officer (or team) who has the authority and independence to get the job done right. It creates a clear chain of command so everyone knows who is responsible for what.

Pillar 2: Policies and Procedures

If governance is the leadership, then Policies and Procedures are the rulebook they create. This is where you translate complex regulations into clear, practical instructions that your team can actually use every day. Your code of conduct is the star of the show here, laying out the company's core ethical principles and what’s expected of everyone.

But these documents can't be filled with dense legalese. To be effective, they must be:

- Easy to understand: Written in plain English that anyone can grasp, no matter their role.

- Relevant: Directly tied to the specific risks and realities of your business operations.

- Accessible: Kept in one central, easy-to-find place so people can look them up when they need to.

Good policies act as a reliable guide for making tough calls, cutting down on confusion and ensuring everyone is on the same page.

Pillar 3: Risk Assessment

You can’t defend against threats you don’t see coming. The Risk Assessment pillar is the engine that drives your entire compliance program. It’s a systematic process for finding, analyzing, and prioritizing the specific legal, regulatory, and ethical risks your company faces. This isn’t a one-and-done task; it's a continuous loop that has to adapt as your business and the rules change.

For instance, a software company will be laser-focused on data privacy risks like GDPR, while a construction firm might be more concerned with OSHA safety rules. This process helps you put your resources where they’ll have the most impact. It's also critical when dealing with third parties; a thorough vendor risk assessment ensures your partners and suppliers aren’t creating blind spots in your compliance.

Pillar 4: Training and Communication

Policies are worthless if they just sit in a folder, unread. Training and Communication is the pillar that breathes life into your program, turning words on a page into active, working knowledge. Real training is more than a once-a-year slideshow. It needs to be engaging, specific to different roles, and ongoing.

The aim is to make sure every single employee understands their obligations and knows exactly what to do when they spot a potential problem. Communication keeps the momentum going with regular updates, newsletters, and messages from leadership. This constant conversation helps weave compliance and ethics into the fabric of your daily work.

Pillar 5: Monitoring and Auditing

Trust, but verify. The Monitoring and Auditing pillar is your reality check. It involves ongoing activities to make sure your controls are actually working the way you designed them to. This might mean running regular internal audits, using data analytics to flag strange patterns, or reviewing employee conduct.

A well-designed compliance program has confidential communication channels. Employees can use them to report misconduct without fear of retaliation, providing invaluable insights for continuous improvement.

Monitoring helps you catch small issues before they blow up into full-blown crises. Auditing, on the other hand, is a more formal, periodic health check on the entire program, pointing out weaknesses and opportunities for improvement.

Pillar 6: Enforcement and Discipline

A compliance program needs to have teeth. The Enforcement and Discipline pillar is about making sure the rules apply to everyone, equally and fairly. When someone breaks a rule, there has to be a clear process for investigating and taking appropriate disciplinary action—no matter who the person is.

This consistency is crucial for building trust and showing that the company truly stands by its ethical commitments. But it's not all stick and no carrot. It’s just as important to have a system for rewarding people who demonstrate strong ethical behavior. This shows that integrity is valued just as highly as performance.

Pillar 7: Incident Response and Remediation

No matter how good your defenses are, things can still go wrong. The final pillar, Incident Response and Remediation, is your game plan for when a crisis hits. It’s a pre-defined process for investigating potential violations, containing the damage, and taking swift corrective action.

A strong response plan allows you to act quickly and decisively, which can dramatically reduce legal penalties and protect your reputation. The second half of this is remediation—fixing the root cause of the problem so it never happens again. This commitment to learning from mistakes is what separates a mature compliance program from a superficial one.

Recent findings highlight a critical gap between policy and practice. In the realm of ethics and compliance, a comprehensive framework spans key dimensions like culture, board oversight, written standards, and enforcement. However, a global study reveals uneven maturity levels and a disconnect between policy creation and actual practice, especially among middle managers where enforcement often falters. Read the full research about these compliance program maturity findings.

Applying Frameworks to Real-World Scenarios

Knowing the seven pillars gives you the "what" and "why" behind a compliance program. But now it's time to connect that theory to what actually happens on the ground. This is where compliance frameworks enter the picture—they're the blueprints that show you exactly how to build your program to meet specific legal or industry standards.

Think of it like this: the seven pillars are the universal principles of building a house (a solid foundation, strong walls, a leak-proof roof). A framework like ISO 27001, on the other hand, is the specific architectural plan for a highly secure fortress. It details everything from the type of lock on the front door to the thickness of the walls, turning general principles into concrete, actionable requirements.

ISO 27001: Information Security in Action

Let’s start with a big one: ISO 27001. It’s one of the most recognized frameworks for information security, helping organizations of all sizes protect critical assets like financial data, intellectual property, and customer information.

An ISO 27001 compliance program doesn't just vaguely suggest you "protect your data." It requires you to build and maintain a formal Information Security Management System (ISMS). This system is a very practical application of the seven pillars, demanding specific controls and, crucially, documented evidence that they're working.

For instance:

- Risk Assessment: ISO 27001 mandates a formal, documented risk assessment process. It’s not optional. You have to identify threats to your information assets. This process might reveal that your customer database is a high-risk asset, which naturally leads to the next step.

- Policies and Controls: Based on that risk, the framework specifies certain controls. A classic example is Annex A.12.1.2 Protection against malware. This means you must have defined policies and technical controls for antivirus software, network filtering, and user awareness.

- Monitoring and Auditing: You’re required to run regular internal audits of your ISMS. This ensures your controls are actually effective and helps you maintain compliance over the long haul.

By following the ISO 27001 framework, a company transforms the abstract idea of "security" into a tangible, auditable program that gives customers and partners real confidence.

HIPAA: Protecting Patient Health Information

Now, let's switch gears to a heavily regulated industry: healthcare. In the United States, the Health Insurance Portability and Accountability Act (HIPAA) is the law of the land for protecting sensitive patient health information (PHI). A healthcare provider’s compliance program is built from the ground up on HIPAA's rules.

While security is a big piece of it, a HIPAA-focused program places a unique and intense emphasis on patient privacy. The framework dictates specific actions that reflect the seven pillars, but they're all tailored to healthcare.

The real differentiator in a HIPAA program is its relentless focus on the use and disclosure of protected health information. Every policy, training module, and control is designed to answer one key question: Is this specific use of patient data legally permitted?

Here’s how a HIPAA program puts the pillars into practice:

- Governance: HIPAA requires every covered entity to formally appoint a Privacy Officer and a Security Officer. These aren't just suggested roles; they are mandated by law to ensure direct accountability.

- Training: Anyone who handles PHI—from doctors to billing clerks—must go through regular HIPAA training. This is a non-negotiable legal requirement with serious penalties for non-compliance.

- Incident Response: The HIPAA Breach Notification Rule is a very specific playbook. If a data breach involving unsecured PHI happens, your program must have a documented process for notifying affected individuals, the government, and sometimes the media within very tight deadlines.

This all starts at the top. The diagram below shows how solid governance, supported by clear policies and continuous training, creates the structure every strong compliance program needs.

The visual makes it clear: strong leadership provides the authority, while policies and training deliver the practical guidance everyone needs to do their part correctly.

Key Compliance Frameworks Compared

Different frameworks solve different problems. While ISO 27001 is about securing data and HIPAA is about protecting patient privacy, others like ISO 9001 focus on quality. Understanding their core purpose is the first step in choosing the right one for your organization.

Here's a quick comparison to see how they stack up.

| Framework | Primary Focus | Target Industry | Example Requirement |

|---|---|---|---|

| ISO 27001 | Information Security Management | Any industry with sensitive data | Implementing a formal risk assessment and treatment plan. |

| HIPAA | Patient Privacy & Data Security | Healthcare (U.S.) | Appointing a dedicated Privacy Officer and Security Officer. |

| ISO 9001 | Quality Management Systems | Manufacturing, Services, any | Establishing a process for corrective actions to address non-conformities. |

| SOC 2 | Security, Availability, Integrity | SaaS, Cloud Computing, Data Centers | Defining and testing controls related to the five "Trust Services Criteria." |

| ISO 13485 | Medical Device Quality | Medical Device Manufacturing | Maintaining a detailed "Device History Record" for each batch of products. |

Each framework provides a road-tested path to building a program that meets specific expectations, whether they come from regulators, customers, or partners.

The Growing Need for Formal Frameworks

Adopting these frameworks isn't just for a select few anymore. The demand for verifiable, provable compliance is hitting a tipping point. Just look at ISO 27001—a recent survey shows 81% of organizations are either certified or plan to be in the next year. That's a huge jump from 67% the year before.

It doesn’t stop there. A staggering 92% of organizations ran at least two audits or assessments last year, digging into core areas like their written policies (58%), risk assessments (56%), and employee training plans (54%).

The data tells a clear story. Companies aren't just building compliance programs anymore; they're building them against recognized, auditable standards to prove they're serious about security, privacy, and quality.

ISO 9001: A Focus on Quality Management

Finally, let's look at ISO 9001, the global standard for a Quality Management System (QMS). Where ISO 27001 obsesses over security and HIPAA over privacy, ISO 9001 is all about customer satisfaction and making your processes better. A compliance program built on this framework is designed to deliver consistent, high-quality products and services every time.

Key components include:

- Document Control: A core requirement is having a rock-solid system for managing all documents and records tied to quality.

- Customer Focus: The program must include formal processes for understanding what customers actually need and measuring how happy they are.

- Corrective Actions: When something goes wrong with a product or process, you must have a formal system to find the root cause and make sure it never happens again.

Whether you're focused on security, privacy, or quality, these frameworks provide the structure you need. They take the foundational pillars of compliance and shape them into a practical, industry-specific system that produces real business results. For a deeper look at the foundational steps, check out our guide on the relationship between compliance and risk assessment.

The Strategic Benefits of a Well-Run Program

It’s easy to look at compliance as just another cost of doing business—a box-ticking exercise to avoid fines. But that’s a shortsighted and expensive mistake. When done right, a compliance program isn't just a defensive shield; it’s a powerful tool for building a stronger, more trusted, and more efficient company. It turns a begrudging obligation into a genuine competitive edge.

Let's imagine two tech startups, Innovate Corp and NexaTech, both chasing the same big enterprise clients. Their approaches to compliance couldn't be more different. For NexaTech, it's an afterthought—a scramble to pull together documentation only when a potential customer demands it. Their internal processes are a mess, and training is an annual, forgettable event.

Innovate Corp, on the other hand, wove compliance into its DNA from the very beginning. They didn't wait to be asked. Instead, they built clear workflows, trained every single employee on how to handle sensitive data, and kept their documentation in an audit-ready state. They saw it as a reflection of their commitment to quality.

Building Trust and Winning Deals

Now, picture both companies pitching a major financial institution. The client's due diligence team starts asking pointed questions about security controls and operational integrity. NexaTech fumbles. They give vague answers and hand over a jumble of inconsistent spreadsheets, failing to inspire any real confidence.

Innovate Corp’s experience is completely different. They present a clear, organized overview of their compliance posture, walking the client through exactly how they protect data and ensure reliability. Their preparation doesn't just satisfy a requirement; it sends a powerful signal of professionalism and trust. Unsurprisingly, Innovate Corp lands the contract. NexaTech is left scratching their heads.

"It takes 20 years to build a reputation and five minutes to ruin it." - Warren Buffett

This isn’t just a story. It’s a perfect illustration of the real-world ROI of a solid compliance program. You stop playing defense and start using your integrity as a tool for growth.

The Tangible Business Outcomes

The payoff goes way beyond landing one big deal. Companies that truly invest in their compliance programs see ripple effects across the entire organization, turning abstract principles into measurable gains.

Here are a few of the most significant advantages:

- Enhanced Brand Reputation: When you can prove your commitment to doing things the right way, you build incredible trust with customers, partners, and investors. That reputation is a priceless asset that attracts more business.

- Improved Operational Efficiency: Compliance forces you to standardize processes and get rid of ambiguity. The result? Teams run smoother, make fewer mistakes, and waste less time dealing with internal friction.

- Increased Employee Morale: A genuine commitment to ethics starts at the top and filters down. People want to work for a company they can be proud of. Just look at Hilton, which earned its top spot on the Fortune 100 Best Companies to Work For list partly because 95% of its employees agreed that “management is honest and ethical in its business practices.”

- Reduced Risk of Costly Penalties: This one is the most obvious, but it can’t be overstated. Proactively managing your legal and regulatory risks helps you sidestep the crippling fines and reputational nightmares that have sunk countless other companies.

At the end of the day, a well-run compliance program is one of the smartest investments you can make. It pays you back in customer loyalty, operational excellence, and the kind of long-term stability that lets you focus on building something great.

How to Build and Implement Your Compliance Program

Knowing the theory is one thing, but rolling up your sleeves and putting it into practice is where the real work begins. Building a compliance program from scratch—or reinforcing one that already exists—can feel like a massive undertaking. The trick is to treat it like building a house: you start with a solid foundation and add to it one methodical step at a time.

This isn’t about trying to create a flawless, all-encompassing system in a week. It’s about building a practical framework that can grow and adapt with your business. By following a clear, phased approach, you can turn abstract goals into concrete actions that actually work in the real world.

Phase 1: Secure Leadership Buy-In and Assign Oversight

Every great compliance program starts at the top. Leadership buy-in is more than just getting a signature on a budget request; it's about securing active, visible sponsorship from your executives. When leaders are vocal champions for compliance, they set the "tone at the top," and that attitude trickles down through every department.

With that commitment in hand, the next move is to assign clear ownership. You need to designate a Chief Compliance Officer (CCO) or a dedicated team that has the authority and independence to get the job done. This creates accountability and gives everyone a clear point of contact for anything compliance-related.

Phase 2: Conduct a Comprehensive Risk Assessment

You can't protect your business from risks you don't know exist. The risk assessment is the diagnostic heart of your entire compliance program. It’s where you systematically dig in to find the specific legal, regulatory, and ethical weak spots your business has, based on your industry, operations, and where you do business.

This step is absolutely critical. It informs every other decision you'll make, helping you put your time and money where they’ll have the biggest impact. A good assessment ensures your program is custom-fit to your actual risk profile, not just some generic template.

Phase 3: Develop and Document Policies and Procedures

Once you have a clear map of your risks, you can start writing the rulebook. This usually begins with a Code of Conduct, which lays out the ethical values and core principles of your organization. From there, you'll develop more specific policies and procedures that turn those big ideas and legal rules into practical, everyday instructions for your team.

An effective policy is one that an employee can actually understand and use without needing a law degree. Keep the language simple, clear, and direct. Make sure all these documents live in one central place where everyone can easily find them.

The goal is to create an actionable playbook that eliminates confusion and helps employees make the right call, every time.

Phase 4: Establish Continuous Training and Monitoring Systems

Policies sitting on a shelf are useless. Ongoing training is what breathes life into them and embeds compliance into your company culture. This training shouldn't be a one-and-done onboarding task; it needs to be regular and tailored to different roles and their specific risks.

Today’s best programs go beyond just managing risk. A recent Global Compliance Risk Benchmarking Survey highlights a major shift toward proactively shaping corporate behavior. For example, some companies now tie compliance metrics directly to compensation, using performance indicators to reward ethical conduct instead of just punishing mistakes. This is just one of many insights reshaping compliance programs.

Finally, to make sure the program is actually working, you have to implement monitoring and auditing systems. These checks create a feedback loop, helping you see if people are following the rules, find weak spots, and constantly improve your controls. This turns your program from a static document into a living, breathing system that gets stronger over time.

A practical implementation checklist might look something like this:

- Secure Executive Sponsorship: Get visible, vocal support from the C-suite.

- Appoint a Compliance Officer: Designate a leader with real authority.

- Identify Key Risks: Complete a thorough risk assessment.

- Draft Core Policies: Start with a Code of Conduct, then build out from there.

- Launch Role-Based Training: Teach employees what they need to know for their specific jobs.

- Set Up Reporting Channels: Give people a safe way to raise concerns.

- Begin Monitoring: Start audits and reviews to test how well things are working.

- Refine and Improve: Use what you learn to make the program better.

Getting Ready for Audits Faster with Modern Tools

Anyone who's been through a compliance audit knows the feeling: the pre-audit scramble. It’s a frantic, manual hunt for evidence that often feels like a full-time job in itself.

Teams spend weeks, sometimes months, digging through shared drives, ancient email threads, and forgotten spreadsheets. They're just trying to find that one specific document—like a training record for an ISO 27001 audit or a design review for ISO 13485—to satisfy an auditor.

This fire drill isn't just inefficient; it’s a recipe for mistakes. A single missed document or a piece of poorly cited evidence can result in a non-conformity, threatening your certification and shaking the auditor's confidence. This process turns highly skilled compliance pros into glorified document detectives, pulling them away from the work that actually strengthens the program.

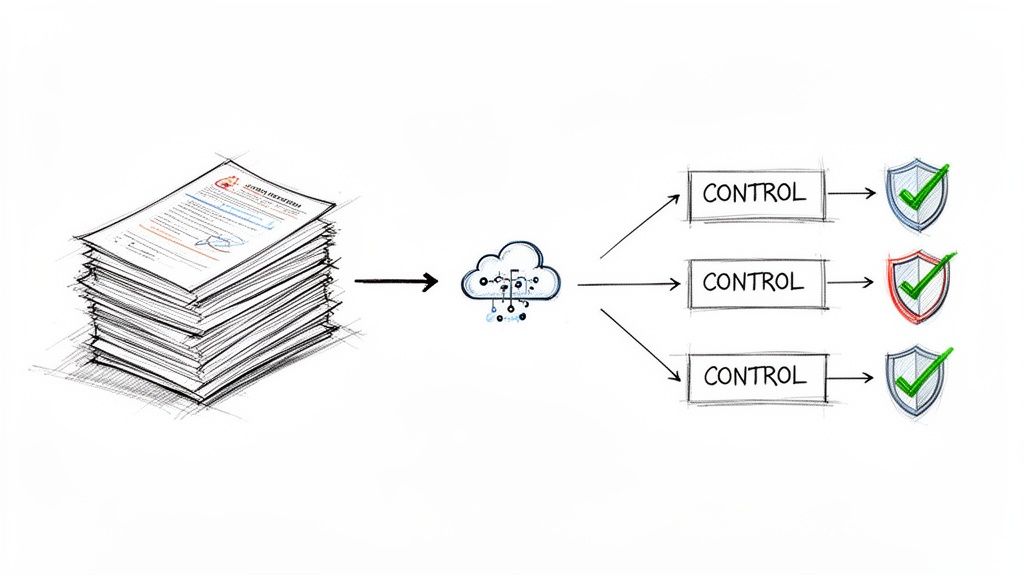

A New Way Forward: Automated Evidence Discovery

Thankfully, we're seeing the end of this painful manual grind. A new generation of tools, many powered by AI, is completely flipping the script on audit prep.

Instead of a human having to search for everything, these platforms can automatically connect to and ingest all your documentation—policies, procedures, meeting notes, system logs, you name it.

An AI agent then effectively reads and understands all of it. So when you need to prove a control is met, you just ask the system. It gives you a direct answer, complete with citations and deep links that take you to the exact page and paragraph in the source document. No more hunting.

Achieving Faster, More Accurate Audits

This isn't just a time-saver; it’s a fundamental upgrade to the quality and reliability of your audit preparation. The difference is night and day.

- Massively Reduced Manual Work: Teams are cutting their evidence collection time from weeks down to a matter of hours. This frees them up for high-value strategic work.

- Pinpoint Accuracy: Automated mapping all but eliminates the risk of missing or misinterpreting evidence. This leads to much cleaner audit outcomes and fewer surprises.

- Always-On Readiness: Your evidence is continuously organized and up-to-date. You can be ready for a surprise audit at a moment's notice.

This isn't just a niche trend. According to a recent survey, 49% of organizations now use technology for 11 or more compliance activities. The most common areas are training (82%), risk assessments (76%), and monitoring (75%).

And the momentum is building. With 82% of companies planning to spend more on automation, it's clear the industry is shifting toward a smarter, tech-first approach to managing compliance.

By adopting these tools, what was once the most dreaded part of the compliance cycle becomes a manageable, verifiable process. Your team gets audit-ready faster and with a whole lot more confidence. To see how these systems work under the hood, check out our deep dive on modern compliance assessment software.

Frequently Asked Questions

It's one thing to understand the theory behind a compliance program, but when you're in the trenches, real-world questions always pop up. Here are some of the most common ones we hear from organizations just starting out or looking to refine their approach.

What’s the First Step in Creating a Compliance Program?

The very first move you should make is a thorough risk assessment. It's tempting to jump straight into writing policies, but without understanding your unique risks, you're just guessing.

A proper risk assessment digs into the specific legal, regulatory, and ethical threats your business faces based on your industry, where you operate, and what you do. This analysis becomes the blueprint for everything that follows. Building a compliance program without it is like building a house without looking at the land first—you're bound to run into trouble.

How Often Should a Compliance Program Be Reviewed?

Think of your compliance program as a living, breathing part of your organization, not a document you create once and file away. It needs, at a minimum, a full review annually.

But that's just the baseline. You should revisit it anytime something significant changes. This could be things like:

- A new regulation that impacts your industry is passed.

- Your company expands into a new country or state.

- You launch a major new product or service.

- You've just dealt with a compliance failure or a security incident.

Regular check-ups keep it relevant and effective.

Can a Small Business Have an Effective Compliance Program?

Absolutely. In fact, it’s a necessity. An effective compliance program isn't about size or complexity; it's about being smart and focused.

A small business won't have the same sprawling framework as a multinational corporation, and it doesn't need to. The key is to scale the core principles to fit your reality. This might mean simpler policies, using more straightforward tools for monitoring, or having one person wear multiple compliance hats.

A small business can build a rock-solid compliance program by focusing on what matters most. Tailor the fundamental elements—like leadership buy-in, risk assessment, clear standards, and training—to your specific risks and resources. The goal is effectiveness, not bureaucracy.

Ready to stop the manual scramble and accelerate your audit readiness? AI Gap Analysis transforms your chaotic pile of documents into audit-ready findings. Our platform automates evidence discovery, maps findings to controls, and gives you clear, cited answers in minutes, not weeks. Start building a smarter compliance program today.